Formula generator for RECEIVED function

The RECEIVED function calculates the amount received at maturity for an investment in fixed-income securities purchased on a given date. It considers the settlement date, maturity date, investment amount, discount rate, and optional day count convention to determine the final amount received.

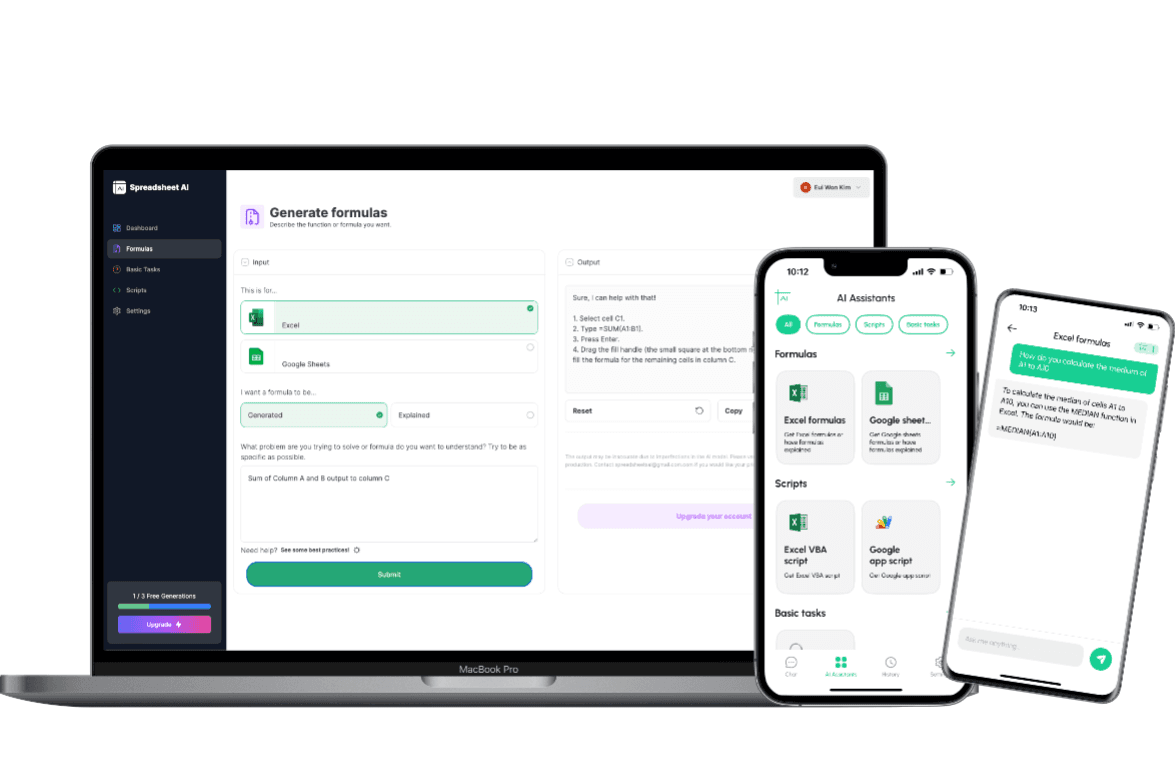

Formula generator

Spreadsheet AI is the #1 AI for generating and comprehending Excel and Google Sheets formulas. With its advanced capabilities, it goes beyond the basics by providing support for VBA and custom tasks. Streamline your spreadsheet with Spreadshee AI

How to generate an RECEIVED formula using AI.

To obtain information on the ARRAY_CONSTRAIN formula, you could ask the AI chatbot the following question: “To get the RECEIVED formula, you can ask the AI chatbot the following question: "What formula can I use in Excel to calculate the amount received for a loan or investment?" The chatbot should then provide you with the RECEIVED formula and guide you on how to use it in your specific scenario.”

RECEIVED formula syntax

The RECEIVED function in Excel calculates the amount received at maturity for an investment with a specified interest rate and term. The syntax for the RECEIVED function is: RECEIVED(settlement, maturity, investment, discount, basis) - settlement: The date on which the investment was purchased. - maturity: The date on which the investment matures. - investment: The initial amount invested. - discount: The discount rate of the investment. - basis: (optional) The day count basis to use for calculations. The function returns the amount received at maturity, taking into account the investment amount, discount rate, and the number of days between the settlement and maturity dates.

Use Cases & Examples

In these use cases, we use the RECEIVED formula to calculate the amount received for a specific transaction or event. The RECEIVED formula takes into account factors such as the initial amount, any discounts or fees, and the interest rate, providing an accurate calculation of the final amount received.

Calculating the amount received at maturity for a bond investment

Description

This use case demonstrates how to use the RECEIVED function to calculate the amount received at maturity for a bond investment. The function takes into account the settlement date, maturity date, investment amount, discount rate, and optional day count convention.

Result

RECEIVED(settlement, maturity, investment, discount, [day_count_convention])

Calculating the amount received at maturity for multiple bond investments

Description

In this use case, we have a table of bond investments with different settlement dates, maturity dates, investment amounts, and discount rates. We can use the RECEIVED function along with other functions like SUM and IF to calculate the total amount received at maturity for all the investments.

Result

SUM(RECEIVED(settlement1, maturity1, investment1, discount1, [day_count_convention]), RECEIVED(settlement2, maturity2, investment2, discount2, [day_count_convention]), ...)

Calculating the amount received at maturity with different day count conventions

Description

In this use case, we want to calculate the amount received at maturity for a bond investment using different day count conventions. We can use the RECEIVED function along with the CHOOSE function to select the appropriate day count convention based on a given criteria.

Result

RECEIVED(settlement, maturity, investment, discount, CHOOSE(criteria, day_count_convention1, day_count_convention2, ...))

AI tips

Enhance Your Excel Efficiency with AI Tips: Discover our innovative Excel add-in feature, ‘AI Tips.’ Streamline your workflow and boost productivity as AI-powered suggestions offer real-time insights for optimal spreadsheet organization, data analysis, and visualization. Elevate your Excel experience with intelligent recommendations tailored to your unique needs, helping you work smarter and achieve more.

Provide Clear Context

When describing your requirements to the AI, provide clear and concise context about the data you have, the specific task you want to accomplish, and any relevant constraints or conditions. This helps the AI understand the problem accurately.

Include Key Details

Include important details such as column names, data ranges, and specific criteria that need to be considered in the formula. The more precise and specific you are, the better the AI can generate an appropriate formula.

Use Examples

If possible, provide examples or sample data to illustrate the desired outcome. This can help the AI better understand the pattern or logic you are looking for in the formula.

Mention Desired Functionality

Clearly articulate the functionality you want the formula to achieve. Specify if you are looking for lookups, calculations, aggregations, or any other specific operations.

FAQ

Frequently Asked Questions

- The RECEIVED function is used to calculate the amount received for an investment, based on the initial investment amount, the discount rate, and the time period.

- The RECEIVED function takes four arguments: investment, discount, maturity, and basis. The investment is the initial investment amount, the discount is the discount rate, the maturity is the maturity date of the investment, and the basis is the day count basis to be used.

- To use the RECEIVED function in Excel, you can enter the formula =RECEIVED(investment, discount, maturity, basis) in a cell. Replace the investment, discount, maturity, and basis arguments with the appropriate values or cell references.

- The RECEIVED function returns the amount received for an investment as a result. This value represents the amount that will be received at the maturity date, taking into account the initial investment amount, discount rate, and time period.

- No, the RECEIVED function can only calculate the amount received for a single investment. If you need to calculate the amount received for multiple investments, you will need to use the RECEIVED function for each investment separately.